Youth unemployment among graduates of short vocational programs such as the Bac Pro or CAP remains a pressing socioeconomic issue. According to the French statistics office INSEE, nearly 20% of these young graduates still struggle to find stable employment after finishing their studies. This often leads to precarious living conditions and a lack of solid financial prospects. In this context, financial freedom emerges as a realistic and sustainable way to help young people escape unemployment and build a stable future. Financial freedom means generating enough passive income to cover daily expenses while ensuring long-term security and independence.

Why Financial Freedom Should Be a Priority After Graduation

Financial freedom means that passive income — from investments, rent, or dividends — exceeds your regular expenses. In practical terms, it’s the ability to live comfortably without depending solely on a salary or a traditional job. For young people with a vocational background, this independence is vital to escape the instability and low pay that often characterize early career experiences.

Graduates of short programs are usually the first to feel the impact of economic downturns or market fluctuations. By prioritizing financial freedom early on, they can break the cycle of insecurity and limited opportunities. It allows them to make smart, forward-looking financial decisions from the very start of their careers and build a foundation for long-term success.

Small Gains, Big Goals: Turning Everyday Purchases Into Investments

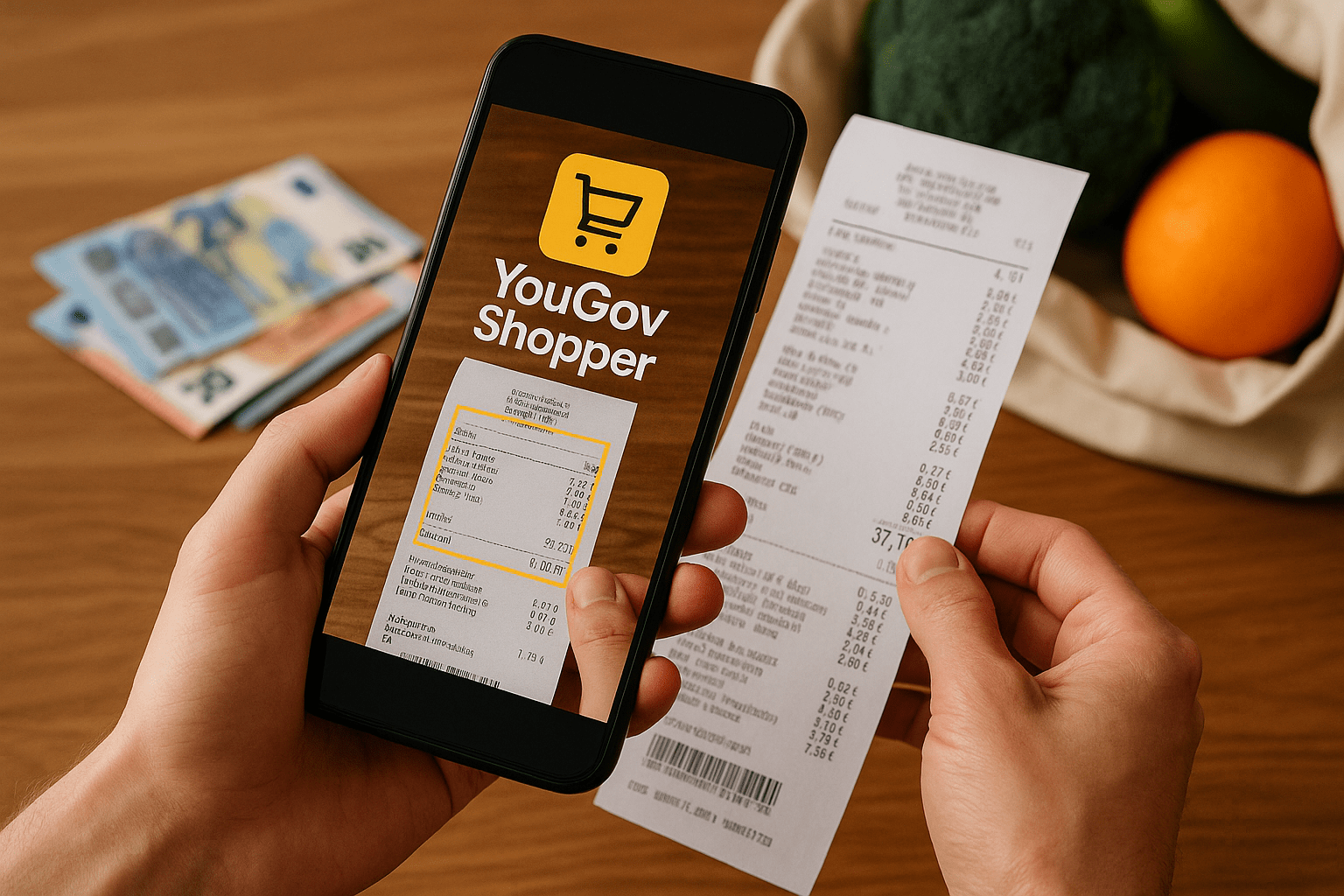

A simple yet powerful approach is to turn daily expenses into capital for investment. The app YouGov Shopper illustrates this innovative idea perfectly: users can scan their everyday receipts to collect points that can be exchanged for cash or vouchers. In this way, every purchase becomes a small step toward building initial investment capital — effortlessly.

Smart Investing: Crypto, P2P, and Stocks — Where to Start?

There are many ways to put small earnings to work effectively. Three popular and accessible options include cryptocurrency, peer-to-peer lending, and ETFs.

Cryptocurrency: Opportunities Despite Volatility

Although cryptocurrencies are highly volatile, they offer strong potential for returns. By investing small, regular amounts, young investors can minimize risks while benefiting from the market’s long-term growth — a strategy that many have already used successfully.

Peer-to-Peer Lending (P2P)

P2P lending platforms provide an accessible entry point into investing. With just a few euros, young people can fund personal or business loans and earn **returns averaging 5–10% per year**, creating a steady passive income stream.

Stock Market Investing Through ETFs

Access to the stock market has become easier thanks to **ETFs (Exchange-Traded Funds)** and mobile trading apps. These tools allow investors to diversify their portfolios with small amounts and enter the market gradually — a smart and low-cost way to start investing.

Managing Investments: The Importance of Discipline and Consistency

Success in investing depends on setting a clear budget and realistic goals. This includes defining a monthly investment amount — even a small one — and sticking to it consistently.

Regular contributions, no matter how modest, benefit from the power of compound interest — the “snowball effect.” Over time, these small sums can grow into substantial wealth. Mobile apps like Finary or Revolut make it easy to track investments in real time, helping users maintain discipline and control.

Boosting Your Capital: Simple Ways to Grow Your Investments

Selling unused items on platforms like Vinted or Leboncoin can quickly generate extra funds to increase your starting capital.

Likewise, leveraging skills learned during training — by offering freelance services on platforms like Fiverr or Malt — can create valuable supplementary income.

Achieving financial freedom after a short vocational education is not just a dream — it’s an achievable and practical strategy. By transforming small daily gains through apps like YouGov Shopper into consistent investments and maintaining a diversified, disciplined approach, young people can progressively build a secure and prosperous financial future. The key to long-term independence starts today — with even the smallest amount invested regularly.